Here we are sharing a piece of big news with you Delayed gratification involves funding now for your economic goals, which may lead to delaying spending money on enjoying life today. Instant gratification involves spending money on enjoying life today which can lead to pushing back investments for financial goals. Several people are caught between instant and delayed gratification and can’t decide which one to go for. Now many people are super curious to know about it. Here we have more information about the news and we will share it with you in this article, so let’s continue the article.

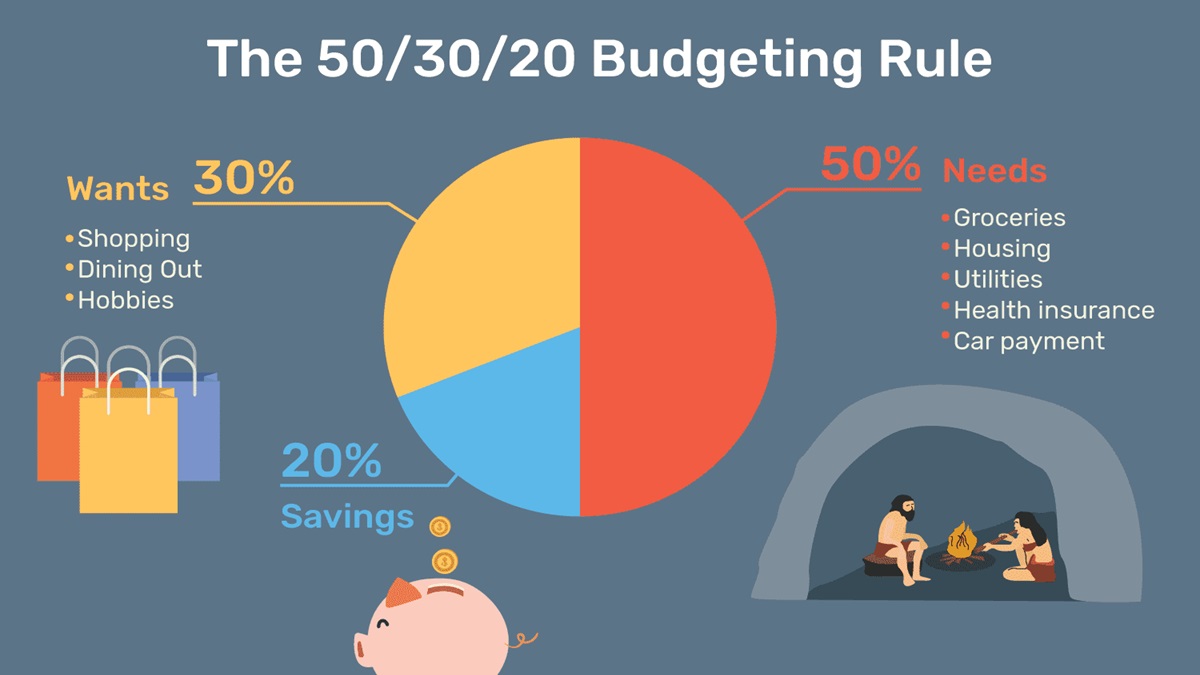

The best choice is to take a balanced system that involves a mix of both. The 50/30/20n budgeting balances enjoying today and ensuring prospective financial goals. Currently, this news has been making headlines on the internet as lots of people are searching about the 50/30/20 budgeting. You are on the right page for more information, so please read the article until the end.

What is 50/30/20 budgeting?

As per the report, it is a budgeting process that involves giving your earnings towards your expenses (needs and wants) saving,s, and assets in specific proportions as follows.

Needs

You may give 50% of your income towards needs. These are essential expenses that must be addressed. Some of these expenses include:

1. House rent

2. Medicines

3. Groceries

4. Loan EMIs, credit card outstanding, insurance premiums, etc.

5. Utility bill payments

6. Children’s education fees and other related expenses

7. Transport expenses

8. Any other non-negotiable expenses

All the above requirement-based spending is essential for survival.

Wants

You can allocate 30 percent of your income towards wants. These have been discretionary or lifestyle costs. Although they are not as necessary as want, you may create them to enjoy life. Some of these expenses include:

1. Films and other forms of entertainment like sports, OTT, and other things.

2. Travelling, holidays, etc.

3. Dining out or ordering food

4. Shopping

5. purchasing or glorifying the latest gadget.

Savings and investments

You can give 20 percent of your earnings towards savings and investments you may utilize this money to get financial goals and secure yours further. Some of these include:

1. Building and maintaining an emergency fund.

2. Investing towards your financial goals as a child’s more elevated education and marriage fund, own and spouse; ‘s retirement fund, building a fund for starting a fresh business, house down payment, etc.

3. Buying term insurance for self, health insurance for family, general insurance for assets like vehicle, house, etc. Here we have shared all the information that we had. Stay tuned to us for more updates.