In case you are scrambling to the internet to learn about the LIC Jeevan Dhara 2 Plan 872, you are at the right destination. We have explained all the eligibility criteria for LIC Jeevan Dhara 2 Plan 872 and what are the death benefits of this scheme introduced by LIC of India. LIC Jeevan Dhara 2 Plan 872 is a new individual, deferred annuity, and savings plan. Reportedly, this scheme has been made available for purchase on Monday, January 22, 2024. Since LIC of India introduced its deferred pension plan, people who have decided to make their family’s future safe, have been eagerly scrounging the weblogs to learn all the bits and pieces of this scheme. In the following sections of this article, we have explained its key features, schemes based on age groups, and annuity rates. You can consider this article as a one-stop place to get details about LIC Jeevan Dhara 2 Plan 872. Stick with this page and go through the article till the end. Drag down the page.

LIC Jeevan Dhara 2 Maturity Calculator

On January 22, 2024, Monday, LIC of India brought LIC Jeevan Dhara 2 Plan 872 to light and made it available for sale. According to the report, the annuity in this scheme is guaranteed from the inception of the scheme. There are as many as 1 annuity options available for the policyholders. The higher age means a higher annuity rate in this scheme. During the deferment period of this scheme, the life cover will also be available. Shift to the next section and read more details.

Speaking of the minimum and maximum age for this policy, the minimum age at entry for the policyholder should not be less than 20 years and the maximum 80, 70, or 65 years minus the deferment period depending upon the annuity. Nevertheless, the LIC of India also facilitates the policyholders to choose from regular and single premium, single life and joint life annuities, and available deferment periods. Shift to the next section and read more details.

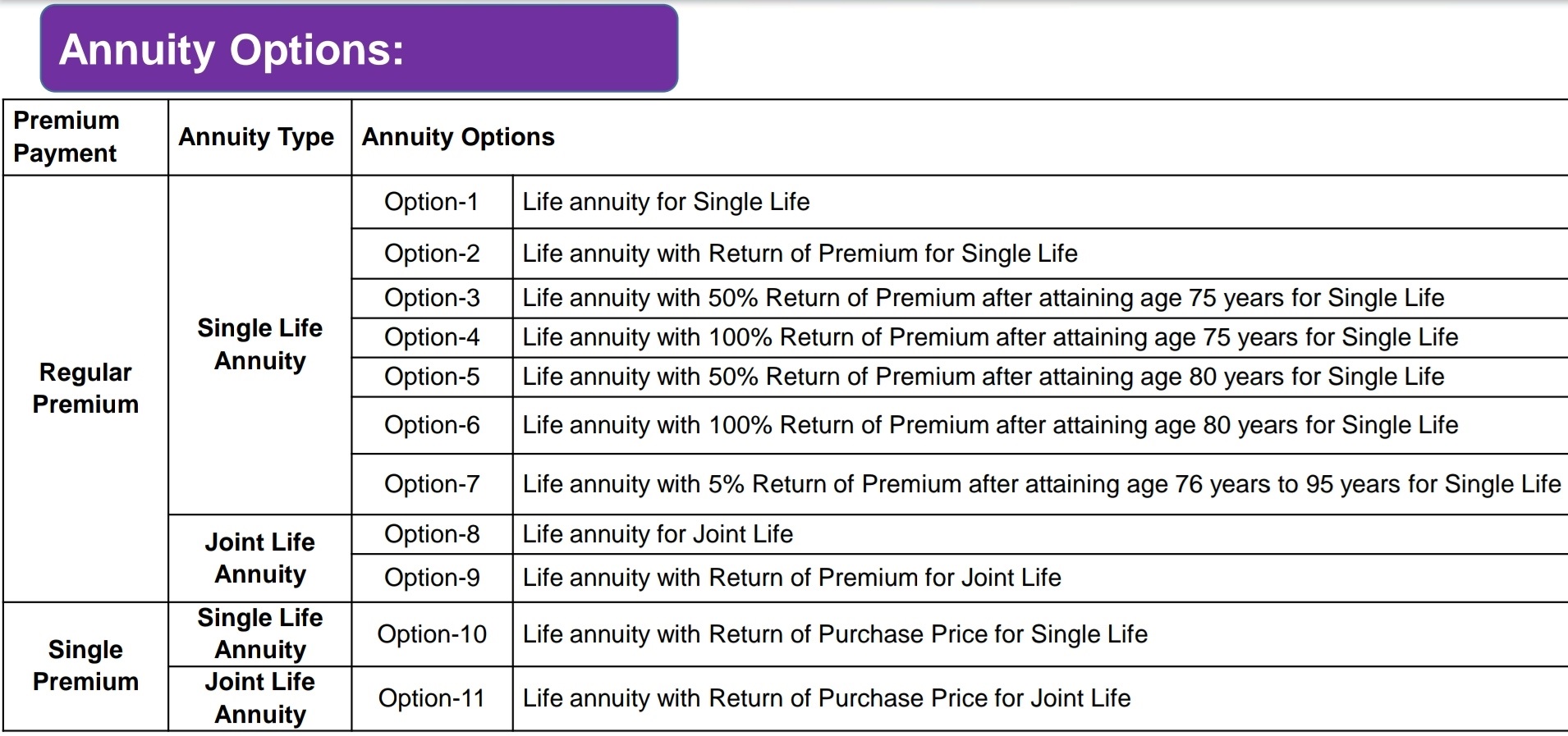

Annuity Options

The other key features of this policy are subject to certain conditions including a top-up annuity and the option to receive an approximate amount in return for a reduction in the payments and incentive by way of a rise in the annuity rate for high purchase/premium price. There is a Unique Identification Number for LIC Jeevan Dhara 2 that is UIN: 512N364V01. Scroll down the page and take a look at the key features of this policy introduced by LIC of India on January 22, 2024.

LIC Jeevan Dhara-2 Plan 872 Parameter/Eligibility

The first feature of this policy is there is a guaranteed annuity in this policy which is even from the inception. As many as 11 annuity options are available for policyholders. Second the higher the age of the policyholder the higher the annuity rate he will receive. In this scheme, life cover is also available during the deferment period. As mentioned, LIC has given diverse options to choose from regular premium and single premium, joint life annuity, and single life annuity, The mode of annuity payments is available yearly, half-yearly, quarterly, and monthly. Note that once you choose the annuity option, it can not be changed in the future.

In the case of a single premium, from 1 year to 15 years which is when to start annuity payments as per your need and the second is a regular premium from 5 years to 15 years. However, an option to increase or top-up annuity has been given under the policy by paying for an additional premium at any time during the period of deferment or when the policy is in force.

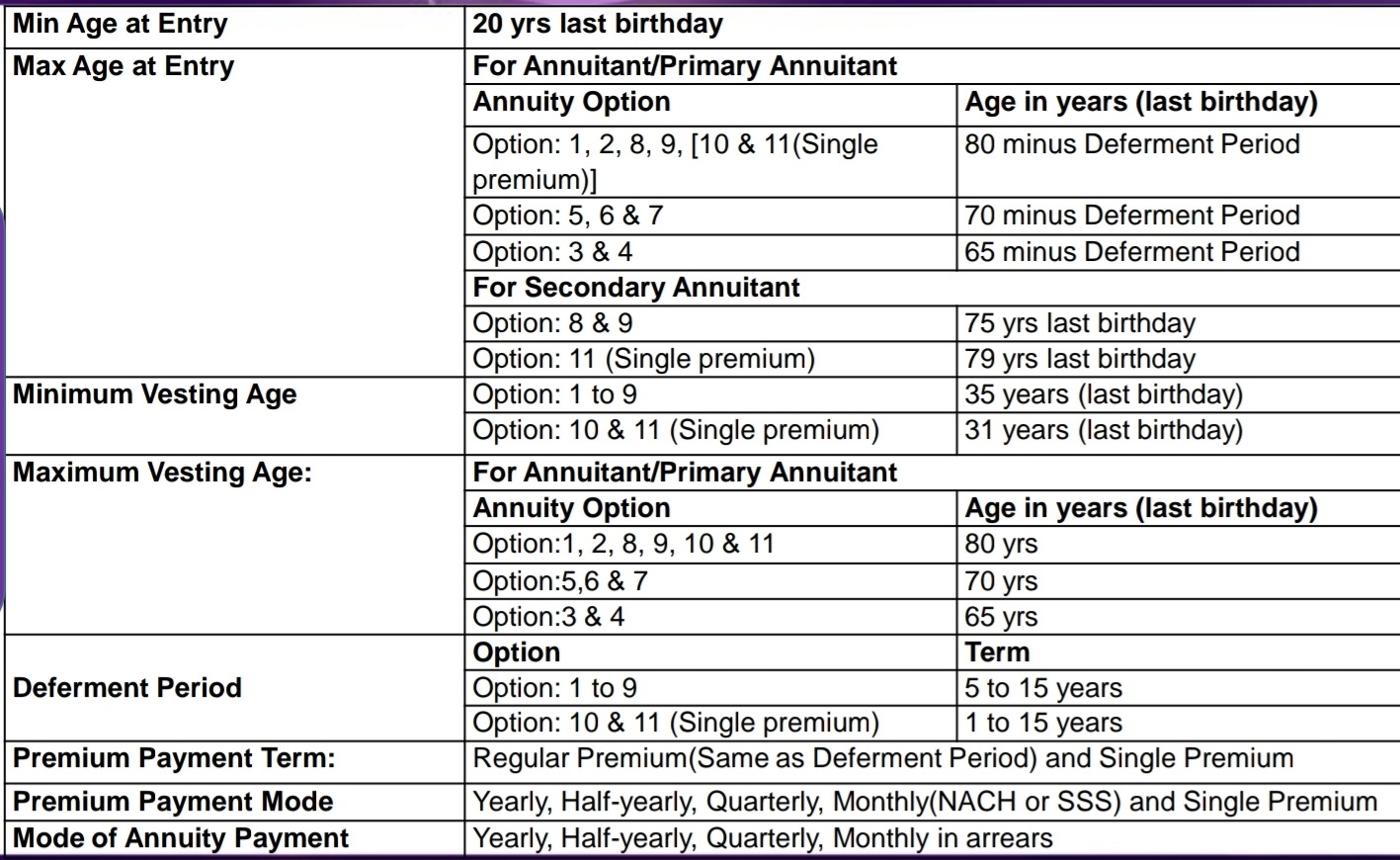

Minimum Yearly Premium(Regular Premium)

The very important feature of LIC Jeevan Dhara 2 Plan 872 is that there is an option to take a death claim. Yes, this policy also covers the life claim which proceeds approximately in the form of annuity or installments. An option to receive the approximate amount in return for a reduction in annuity payments is a liquidity option. The benefits are available under annuity options with the purchase price of return of premium. A loan option will be available after the deferment period under annuity options with Purchase Price or Return of Premium. Continue reading this article for more details.

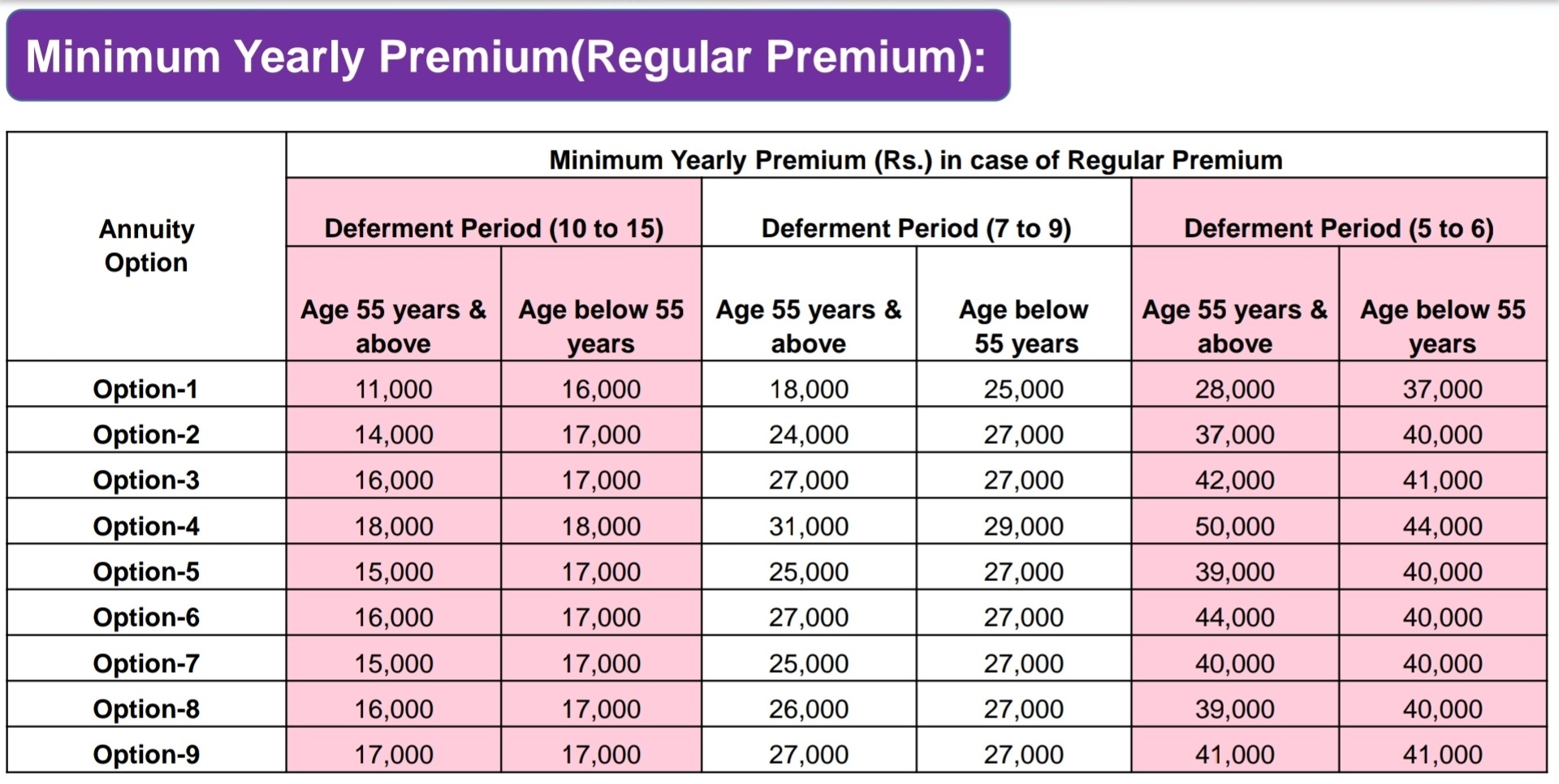

Minimum Purchase Price for Single Premium

What are the conditions for surrendering the policy before maturity? For the single premium policies, the policy can be surrendered at any time on payment of purchase price while under the regular premium policies, the policy can be surrendered at any time after or during the deferment period given. The foremost condition is the premiums have been paid for a minimum of two consecutive years.

What if you are unable to pay the premium for some time and you want to revive your policy after some time? Speaking of the revival of the policy, it can be revived within five consecutive years from the date of the First Unpaid premium. Stay tuned to this website for more details and further updates.